straight life policy formula

This traditional life insurance is sometimes also known as. The primary unit for figuring out a life insurance rate is the rate per thousand cost per 1000 of insurance which can vary depending on which.

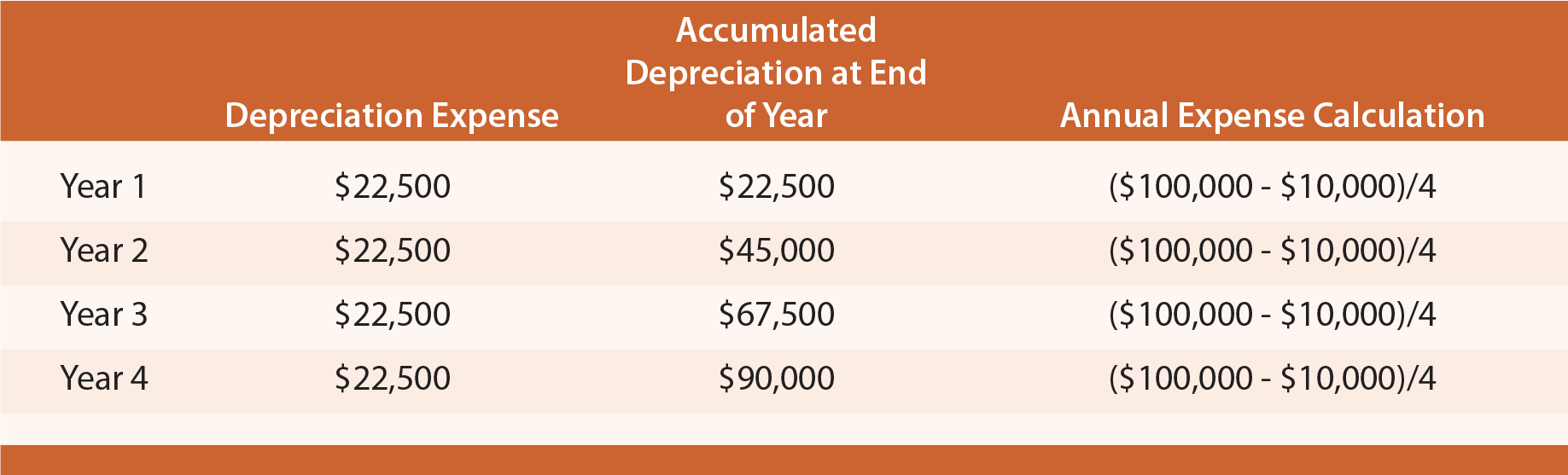

Depreciation Expense Double Entry Bookkeeping

MIP Graded Fixed and Plus and Basic.

. Age of the applicant. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums.

Number of children of the applicant. The first two arguments are the same as they were in Section 1 with the other arguments. 1 2013 MIP 7 and Basic 4 retained 15.

Looking for information on Straight Life Policy. 401 k College Planning Estate Planning Financial Planning Getting. To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset.

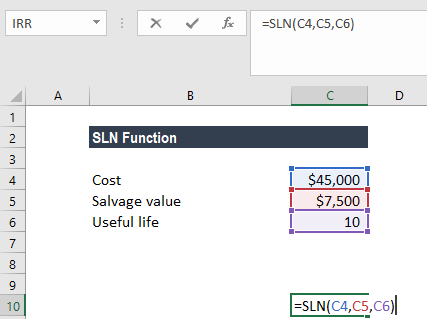

Determine the cost of the asset. Straight line depreciation method charges cost evenly throughout the useful life of. The formula is cost salvage useful life in units units produced in period.

The straight line calculation steps are. Gender of the applicant. FAC x 15 x YOS before Feb.

A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. You can determine the annual depreciation rate of an asset with the following formula. A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single.

Also known as whole or ordinary life insurance the policy has. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15. FAC x 125 x YOS on or after Feb.

Estimate how much coverage you may need to replace your income and get a quote. 1 Years of useful life. The useful life of the assethow many years you think it will last.

Straight line depreciation can be calculated using the following formula. Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life. The rate of Depreciation Annual Depreciation x 100 Cost of Asset.

The annual income of the. If the above copier has a useful life of five years according to the IRS the. Click to go to the 1.

Premium formula namely the pure n-year endowment. After death however the payments cease and the. Term Life Insurance Quote Tool.

The straight line calculation as the name suggests is a straight line drop in asset value. Cost - Residual Value Useful Life. A straight life insurance policy can also build cash value over time.

The depreciation of an asset is spread evenly across the life. The prospective policy buyer should enter the following details. How are life insurance rates calculated.

Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. The expected present value of 1 one year in the future if the policyholder aged x is alive at that time is denoted in older books as nEx and. IRMI offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere.

Amount of Depreciation Cost of Asset Net Residual Value Useful Life.

Straight Line Depreciation Template Download Free Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

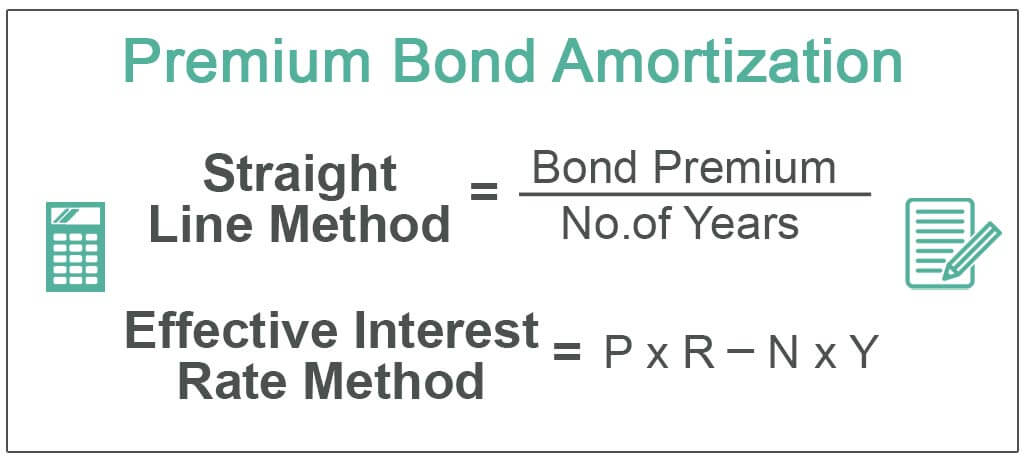

What Are The Difference Between Annual Straight Line Amortization Vs Effective Interest Amortization The Motley Fool

Depreciation Formula Calculate Depreciation Expense

Amortization Of Bond Premium Step By Step Calculation With Examples

Straight Line Depreciation Formula Guide To Calculate Depreciation

Sln Function Excel Formula For Straight Line Depreciation Examples